When I came across the June 8, 2021 meeting minutes for the Jackson Township Trustees, I was shocked, no disgusted, that our Township administration (Administrator/Law Director, Fiscal Officer, and Trustees) created a special district in order to build the Residences at the Greens apartments. What did creating this Energy Special Improvement District enable them to do? Let me enlighten you.

Here’s the video I did, if you prefer to just watch:

Energy Special Improvement District

The first, and most offensive* in my opinion, was to use green energy money to finance the project and utilize tax assessments to repay the loans. Yes, tax assessments on the property itself, so essentially the renters at these apartments (not senior housing, per this article) will pay back the loan for the owner (ABC Gardens LLC).

The funding came from OHPace.org which is designed to be used for commercial energy efficient and energy producing projects.

Green Energy Racket

Ohio created legislation that allows government entities (Jackson Township in this case) to create Energy Special Improvement Districts (ESID) which feed into the whole misuse of green energy money, and the Great Reset agenda. The World Economic Forum declared, “By 2030 we will own nothing and be happy. And here we are, seeing government entities (in this case Jackson Township) creating an ESID so a construction management firm could act as the owner and build this project in our township. This is collusion between our township and ABC Gardens (CM Firm who owns the Residences at the Greens).

Section 1710 | Special improvement districts

The Special Energy Improvement District: Sect. 1701.10 (I) “Special energy improvement project” means any property, device, structure, or equipment necessary for the acquisition, installation, equipping, and improvement of any real or personal property used for the purpose of creating a solar photovoltaic project, a solar thermal energy project, a geothermal energy project, a customer-generated energy project, or an energy efficiency improvement, whether such real or personal property is publicly or privately owned. You can make your own judgement if the project is in fact “green” because in my experience working on LEED projects, HERS rated projects and designing energy efficient homes, it is not. It’s barely above the Energy Code we have adopted, and to my knowledge has not had any energy audit done. The project is nearing completion (Nov. 2021) so maybe that is forthcoming.

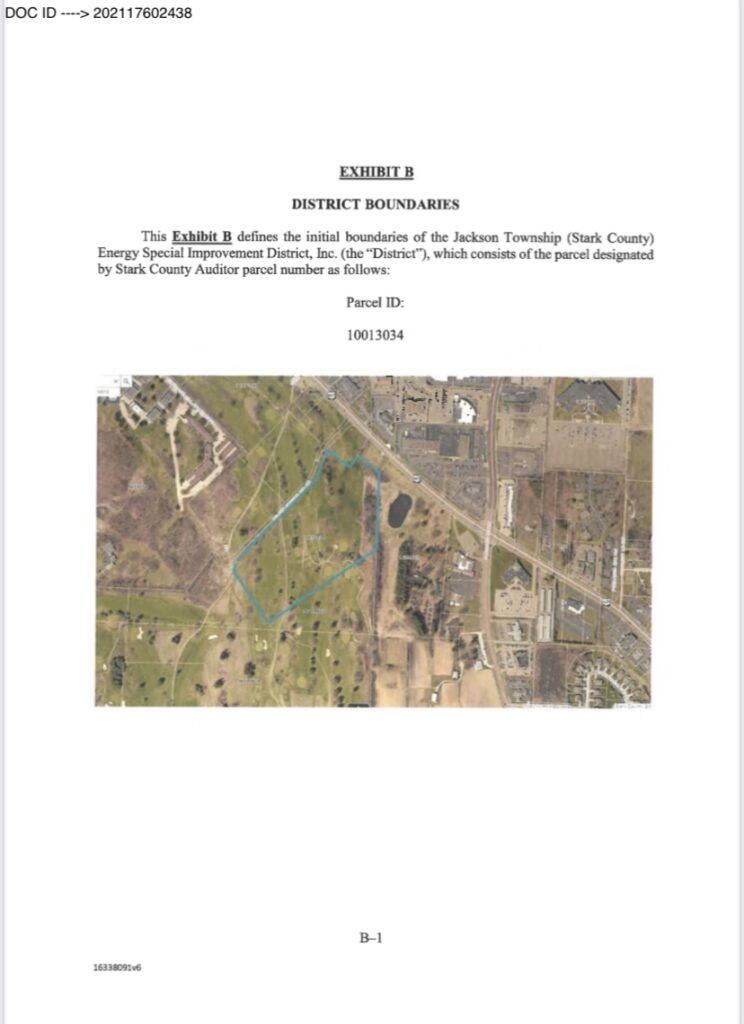

I did request (From Mike Vaccaro, Jackson Township Administrator and Law Director) the extents of the ESID. I got this response, but also found it in the Articles of Incorporation for the ESID.

My request:

Site plans that show the extents of the Stark County ESID.

His response:

Jackson Township is not in possession of a document that satisfies this request. The ESID can be expanded to include basically any property in Jackson Township. The resolution as previously provided to you does indicate the parcel ID and other information as to that particular project.

Here is the extents of the “District” i.e. ESID, pretty much the Residences at the Greens:

$11 Million Dollars of…. profit?

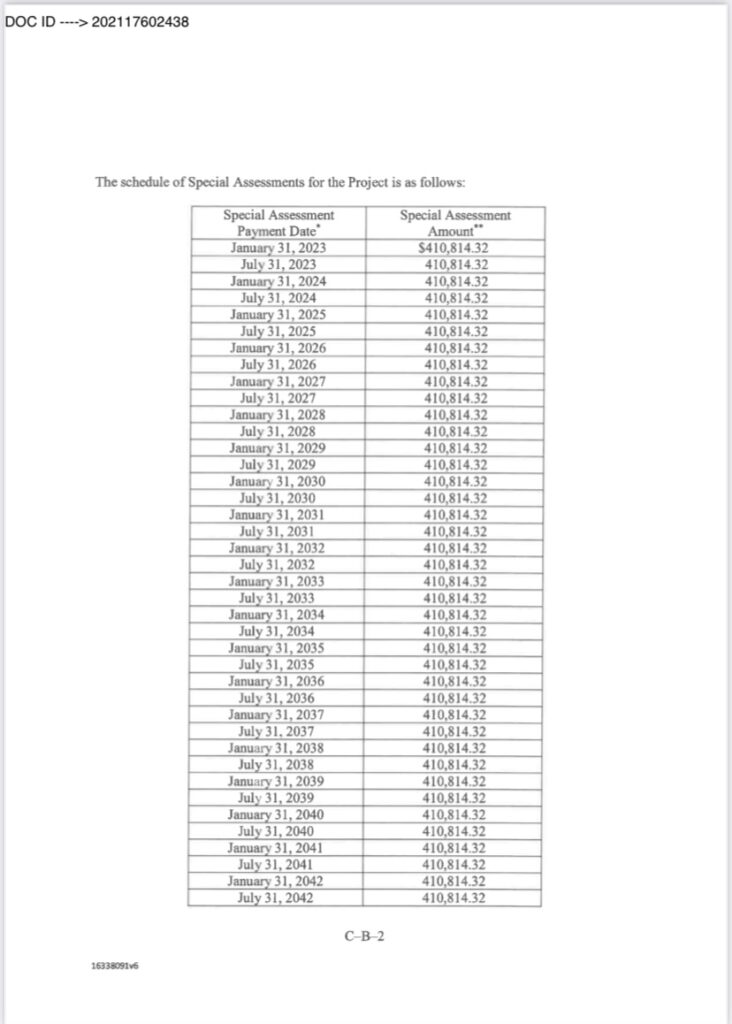

This project is costing $16 Million dollars to build according to the Trustee Meeting minutes of June 8th, and the taxes will be assessed to repay that amount. However, it appears that the initial funding from PACE (image above) was for $5.8 M, so that leaves the discretionary amount of profit at approximately $11 Million. They (Owners and Township) set the amount at $16 M and sent that number to the Stark County Auditor to add to the taxes for the Residences at the Greens. When I requested information from the Township, who should be holding these financial documents according to the Resolution, here was my response.

My information request:

Construction cost estimates that total the $16M – the Stark County Energy Special Improvement District (ESID) was created by our Township Trustees to utilize PACE funding, and the tax assessments total $16,432,572.80 (and yes, I realize no other taxpayers are paying that, it’s being assessed directly to the property).

Mike Vaccaro’s response (Township Administrator and Law Director):

Jackson Township is not in possession of a document that satisfies this request. The aggregate amount of special assessments over 20 years is the approximately $16M number. As detailed in the property owner’s petition to the Township, the special assessments needed to be requested and preliminarily approved in an amount that exceeded the amount actually expected. As requested in the property owner’s petition and approved by the Township, the final rate of interest would be determined, and the final special assessments (expected to be significantly less than the total of $16M) would be certified for collection.

I have seen the exact numbers for the Stark County Auditor’s collection, because it is also in the Articles of Incorporation for the ESID. Here’s a snapshot of the list:

Are the Rich Getting Richer? Yep.

My summary of this whole BS project is that our Township colluded with ABC Gardens LLC to build the Residences at the Greens, only to have the hard working people who rent those apartments (for the next twenty years) pay back the cost of building the project. All the while, the $11 Million in profit is already safe and secure in the Cayman Islands. This is transparency. Not what the elected official (Trustees and Fiscal Officer told you).

Why does the matter?

Because this isn’t the first, and won’t be the last project that does NOT benefits the residents of Jackson Township. I ran for Trustee in the November 2021 election and did not win, and I’m sorry about that. I still believe we can do better and am here to help bring ACTUAL transparency to the township. If you’d like to support me, follow my YouTube channel and donate via Venmo or Paypal. Thank you!

~Amy